The "Simple Bracket" is an order strategy where you place an initial opening order. If that order is filled then a stop-loss and profit target are automatically placed. After the placement of the stop (loss) and limit (target) if one is filled, then the other order is cancelled.

The Simple Bracket allows you to methodically trade the market with a pre-determined target and stop or even engage in a "place it and walk away" strategy where the Generic Trader Professional servers automatically handle the management of your order if the opening order is filled. One benefit is that this order can be placed at anytime (even if the market is closed) and the strategy will kick-off and start right at the pre-opening or start of trading session.

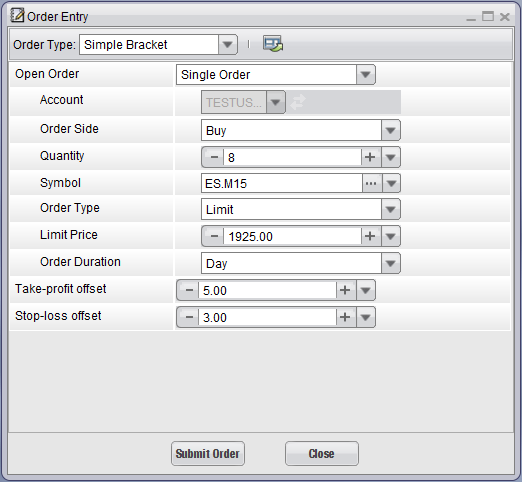

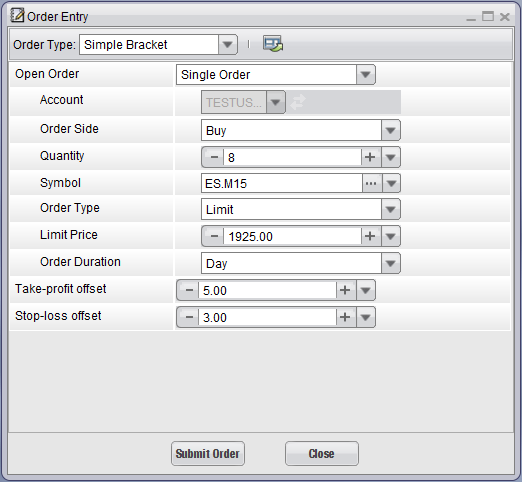

In the example above, we are attempting to purchase 8 contracts of the ES.M15 at 1925.00 Limit.

If the order is filled at 1925.00 (or better), a profit target of +5.00

is placed as a limit order. Assuming we are filled at 1925.00 (and

not a better price) then the target would be 1930.00. Note that

if the market opened lower and we were filled at 1922.00, then the Simple

Bracket is smart enough to place a target at 1927.00 (+5.00 from the entry) A

sell stop is placed at 1922.00 (in the example where we are filled at

1925.00, thus 1925.00 -3.00 = 1922.00).

These two orders are designated as Order Cancels Order ("OCO") whereby if the first order is filled, the second is cancelled or if the second is filled, the first is cancelled.

This is an effective way to automatically place limits and stop orders without having to be glued to screen. You no longer have to wait for your initial fill before you place your limit and stop order; the Simple Bracket Strategy will automatically do this for you when your main order is filled.

Note: The Simple Bracket is intelligent enough to modify and place orders based upon partial fills. So if one of the orders is partially filled, then the strategy will work as expected for a bracket order (e.g. if only 4 lots of the 8 are filled, then 4 lots of limit/stop are placed). Conversely if the profit target (limit) is filled for only 2 contracts, then the stop order quantity is subsequently decreased by 2 contracts.