Stochastics

STOCHASTICS:

Stochastic is an oscillator popularized by George Lane. Stochastic

consists of two lines: a fast line called %K and a slow line called %D. Slow

Stochastics and Fast Stochastics incorporate both %K and %D. The

Fast Stochastic is very sensitive to market turns but leads to many whipsaws. Some

traders therefore prefer the Slow Stochastic which is a little less sensitive

in its identification of market turns, but results in less market noise

and whipsaws. Stochastic is designed to fluctuate between 0

and 100. Popular references line are drawn at 20 and 80 with

the center line at 50. Stochastic shows when bulls or bears

become stronger or weaker. This information helps you decide

whether bulls or bears are likely to win the current "fight"

in the market.

There are generally three types of Stochastic trading signals:

- Stochastic-Divergences: A

bullish divergence occurs when prices for a particular market fall

to a new low, but Stochastic traces a higher bottom than during the

previous decline. When a bullish divergence occurs, this

is sign that the sellers are losing the upper hand and it may be time

to buy. Vice versa, a bearish divergence occurs when prices

rally to a new swing high, but Stochastic traces a lower top than

during its previous rally. This is a sign that the buyers

may be thinning out and it is time to sell.

- Stochastic-Overbought &

Stochastic Oversold: When Stochastic rallies above

its upper reference line (80), it shows that the market is overbought. Overbought

means too high, ready to turn down. When Stochastic falls

below its lower reference line, it shows that the market is oversold. Oversold

means too low, ready to turn up. It is very important to

note that the Overbought & Oversold conditions for Stochastics

only work well when you have a firm feeling that the market is in

a trading range. If the market is in a trend or establishing

a new trend, the Stochastic can be overbought or oversold for a significant

period of time. You do not want to trade against the trend

in these situations.\n\nStochastic: Line Direction\nWhen both Stochastic

lines (%K and %D) are headed in the same direction, they confirm the

short-term trend. When prices rise and both Stochastic

lines rise, the uptrend is likely to continue. When prices

slide and both Stochastic lines fall, the short-term downtrend is

likely to continue.

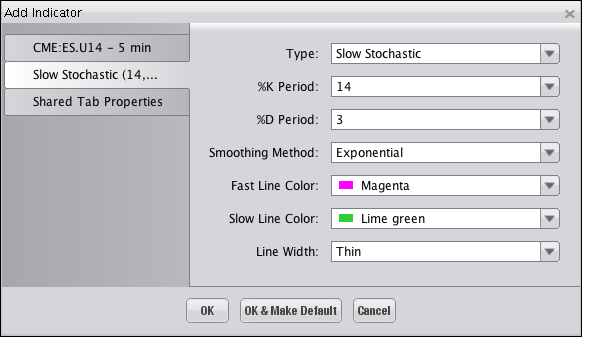

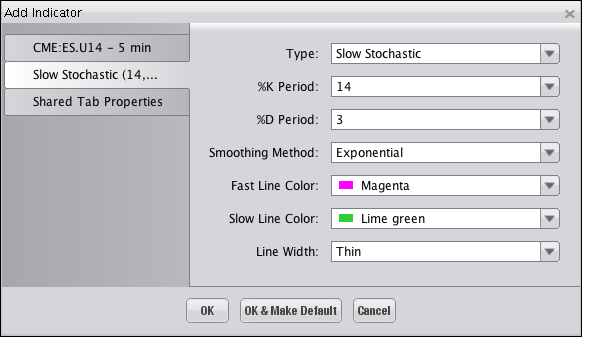

Selecting the Stochastics Indicator on the "Indicators and

Symbols" list displays the "Add Indicator" dialog, illustrated

below, where you an choose among the different options available to have

the Indicator display on the Chart as you'd like it to. Click "OK"

to add the Indicator.

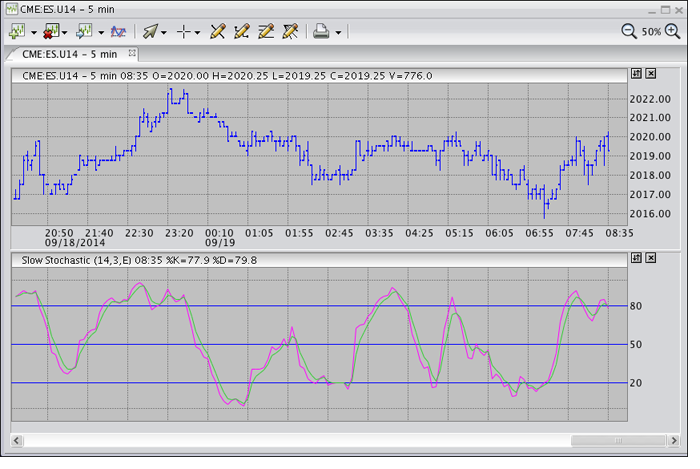

The Indicator is displayed within its own window, as shown in the following

illustration.