A Trailing Stop s a stop order that can be set at a defined point value away from a security's current market price. A trailing stop for a long position would be set below the security’s current market price; for a short position, it would be set above the current price. A trailing stop is designed to protect gains (or limit losses) by enabling a trade to remain open and continue to adjust the stop (to better the profit/loss potential) as long as the price is moving in the right direction, but closing the trade if the price changes direction by a specified amount.

The trailing stop is more flexible than a fixed stop loss, since it automatically tracks the product's price direction and does not have to be manually reset like the fixed stop loss. Like all stop orders, the trailing stop enforces trading discipline by taking the emotion out of the “sell� decision, thus enabling traders and investors to protect positions and investment capital.

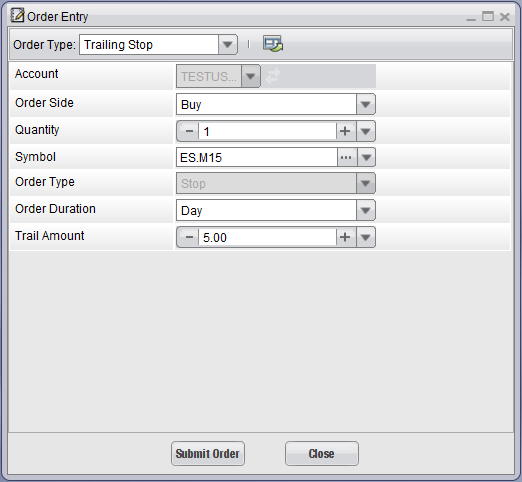

Within Firetip, you select the "Trailing Stop Order Type" from the "Order Type" drop down within the "Order Entry" dialog when you place an Order, as shown in the following illustration.

In the example below, we will buy 1 ES.M15 at 5.00 above the market price (last trade). As the market moves lower, then the trailing stop will "trail" with the market. As an illustration, let's assume the last price is 2000.00. With the 5.00 trailing stop, the initial stop will be at 2005.00. As the market moves below 2000.00, the stop will change to be 5.00 above whatever the lowest price trades at. Let's assume the market falls to a low of 1982.00. In that case, the stop would be 1987.00.

The trailing stop is useful if placed standalone but is also quite powerful if placed in conjunction with order types to create your own customize strategy. For example, you may wish to place a trailing stop that is triggered only if an opening order is filled (an Order Trigger Order, for example).