The Relative Strengths Index (RSI) charting Indicator is a technical momentum indicator that compares the magnitude of recent gains to recent losses in an attempt to determine overbought and oversold conditions of an asset. It is calculated using the following formula:

RSI = 100 - 100/(1 + RS*)

*Where RS = Average of x days' up closes / Average of x days' down closes.

As you can see from the chart, the RSI ranges from 0 to 100. An asset is deemed to be overbought once the RSI approaches the 70 level, meaning that it may be getting overvalued and is a good candidate for a pullback. Likewise, if the RSI approaches 30, it is an indication that the asset may be getting oversold and therefore likely to become undervalued.

A trader using RSI should be aware that large surges and drops in the price of an asset will affect the RSI by creating false buy or sell signals. The RSI is best used as a valuable complement to other stock-picking tools.

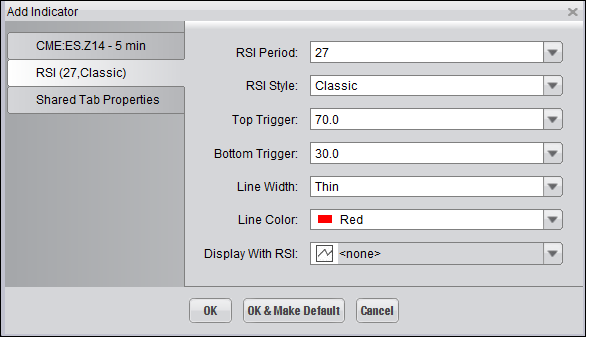

Selecting the RSI Indicator on the "Indicators and Symbols" list displays the "Add Indicator" dialog, illustrated below, where you an choose among the different options available to have the Indicator display on the Chart as you'd like it to. Click "OK" to add the Indicator.

The Indicator is displayed within its own window, as shown in the following illustration.