The formula used in the calculation of Woodie Pivot Points are:

R4 = R3 + RANGE

R3 = H + 2 * (PP - L) (same as: R1 + RANGE)

R2 = PP + RANGE

R1 = (2 * PP) - LOW

PP = (HIGH + LOW + (TODAY'S OPEN * 2)) / 4

S1 = (2 * PP) - HIGH

S2 = PP - RANGE

S3 = L - 2 * (H - PP) (same as: S1 - RANGE)

S4 = S3 - RANGE

Where R1 through R4 are Resistance levels 1 to 4, PP is the Pivot Point,

S1 through S4 are support levels 1 to 4, RANGE is the High minus the Low

for the given time frame (usually daily).

One of the key differences in calculating Woodie's Pivot Point to other

pivot points is that the current session's open price is used in the PP

formula with the previous session's high and low. At the time-of-day that

you calculate pivot points you might not have the opening price so you

could use the Classic formula for the Pivot Point and vary the R3 and

R4 formula as per Woodie's formulas.

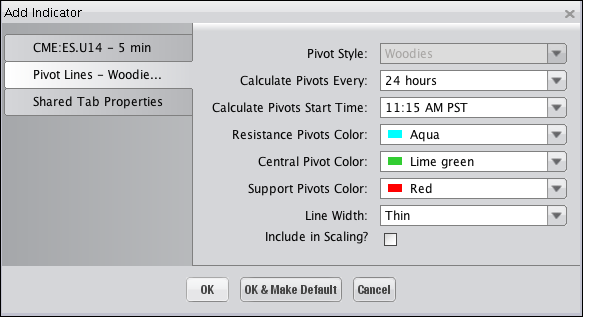

Selecting the Pivot Lines - Woodies Indicator on the "Indicators and Symbols" list displays the "Add Indicator" dialog, illustrated below, where you an choose among the different options available to have the Indicator display on the Chart as you'd like it to. Click "OK" to add the Indicator.

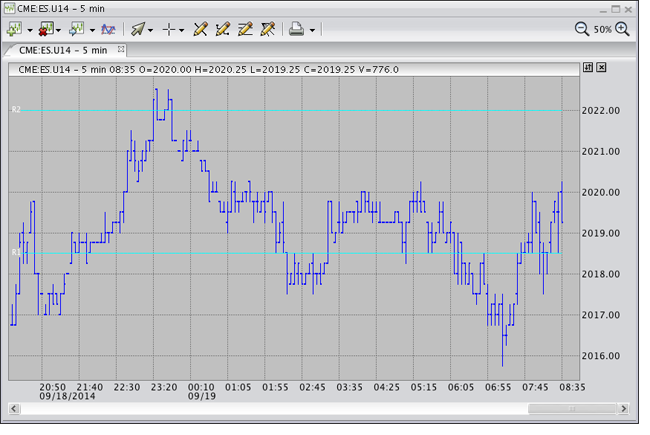

The Indicator is superimposed on the Chart, as shown in the following illustration.