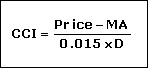

The Commodity Channel Index (CCI) is an oscillator used in technical analysis to help determine when an investment vehicle has been overbought and oversold. The Commodity Channel Index, first developed by Donald Lambert, quantifies the relationship between the asset's price, a moving average (MA) of the asset's price, and normal deviations (D) from that average. It is computed with the following formula:

The CCI has seen substantial growth in popularity amongst technical

investors; today's traders often use the indicator to determine cyclical

trends in not only commodities, but also equities and currencies.

The CCI, when used in conjunction with other oscillators, can be a valuable

tool to identify potential peaks and valleys in the asset's price, and

thus provide investors with reasonable evidence to estimate changes in

the direction of price movement of the asset.

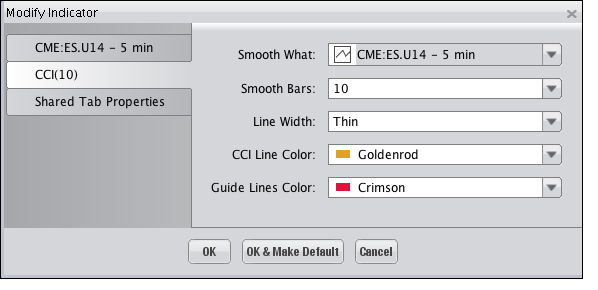

Selecting the CCI Indicator on the "Indicators and Symbols" list displays the "Add Indicator" dialog, illustrated below, where you an choose among the different options available to have the Indicator display on the Chart as you'd like it to. Click "OK" to add the Indicator.

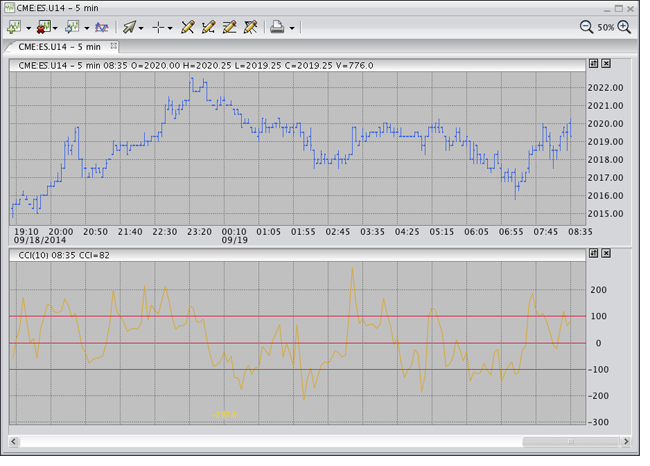

The Indicator is displayed within its own window, as shown in the following illustration.